Our clients often tell us that one of their biggest pain points is the feeling of flying blind while managing their businesses in the early stages. If this resonates with you, a financial model could be an easy solution to help bring clarity to your business decisions. It can also compel you to ask yourself key questions about your business.

What Is a Financial Model?

A financial model tells you where you are and where you are going. It is a tool designed to help you make more educated and number-based decisions. It can be of great value when seeking funding, planning for the future, tracking your performance, and, most importantly, avoiding bankruptcy.

How Do I Use It?

Financial models usually follow a deterministic approach, meaning that they use historical numbers and make basic assumptions about future performance. A typical financial model gives companies an overview of where they stand, and where they would like to go. A good way to think about your financials is to break it up into these four aspects:

1. Revenue

Revenue is arguably the most important aspect of your business. After all, it’s what allows you to grow, pay your team’s salaries, and invest in your product. You may think “revenue is just revenue.” This is where financial models can bring value and help you to understand your drivers. By segmenting revenue streams in different ways, models can help you to focus on the factors (customer profile, product offering, cost etc.) that affect your business. In general, you always want to forecast growth in your revenue, the assumption being that your business is always expanding.

Key Questions – What drives your sales? What are your different revenue streams? What are the costs associated with those different streams? How will new features affect your future sales? What are your current and future acquisition channels? Are you planning to expand your business into other markets?

2. Team Costs

In most cases, your team will be a driving force in your company. For service companies, the team can also be the largest expense. The makeup of your team will depend on your product. If you are a consulting service, your main focus will be on building your team of experts, which will in turn drive your sales. However, if you are selling a SaaS product, your focus will be on growing your sales & marketing teams and hiring engineers.

Hiring can also be driven by other key performance indicators (KPIs). For example, you may want to hire one additional customer support employee whenever your monthly active users grows by 10,000. A model can help you determine these costs and plan for your growing team.

Key Questions – If you are bringing in more revenue, will you need to grow your service delivery staff? Will you incentivise your team through compensation plans? As your business grows, how will you build your team?

3. Sales & Marketing

Some sales & marketing costs can be directly attributed to new customers. For these types of costs, you can measure the return on investment (ROI) of the spend and scale with this number in mind. This strategy is called “push marketing.” On the other hand, pull marketing is spend that may not clearly be attributed to sales. For example, rebuilding your business’s website and improving your SEO might make it easier for customers to find you on the internet. As a result, your business would see an increase in sales. These future sales have no further expense associated and would be a result of pull marketing efforts.

Key Questions – What are your acquisition channels? Are you using a push or pull strategy? How will your marketing strategy evolve as your business grows?

4. Operating Expenses

Operating expenses are probably the least exciting aspect of your business, but they also need careful planning. This includes items such as meals and entertainment for staff, travel, rent, and other equipment. These expenses tend to be driven by head count.

Key Questions – If your team is growing, will you need to upgrade to a larger office? What are your professional, legal, and accounting fees? If you are extending your operations to overseas, will you need to budget for additional travel costs?

Ok, Just Show It to Me Already

We’ve put together a free Financial Template that you can use to map your company’s performance. Contact us today to request your free copy.

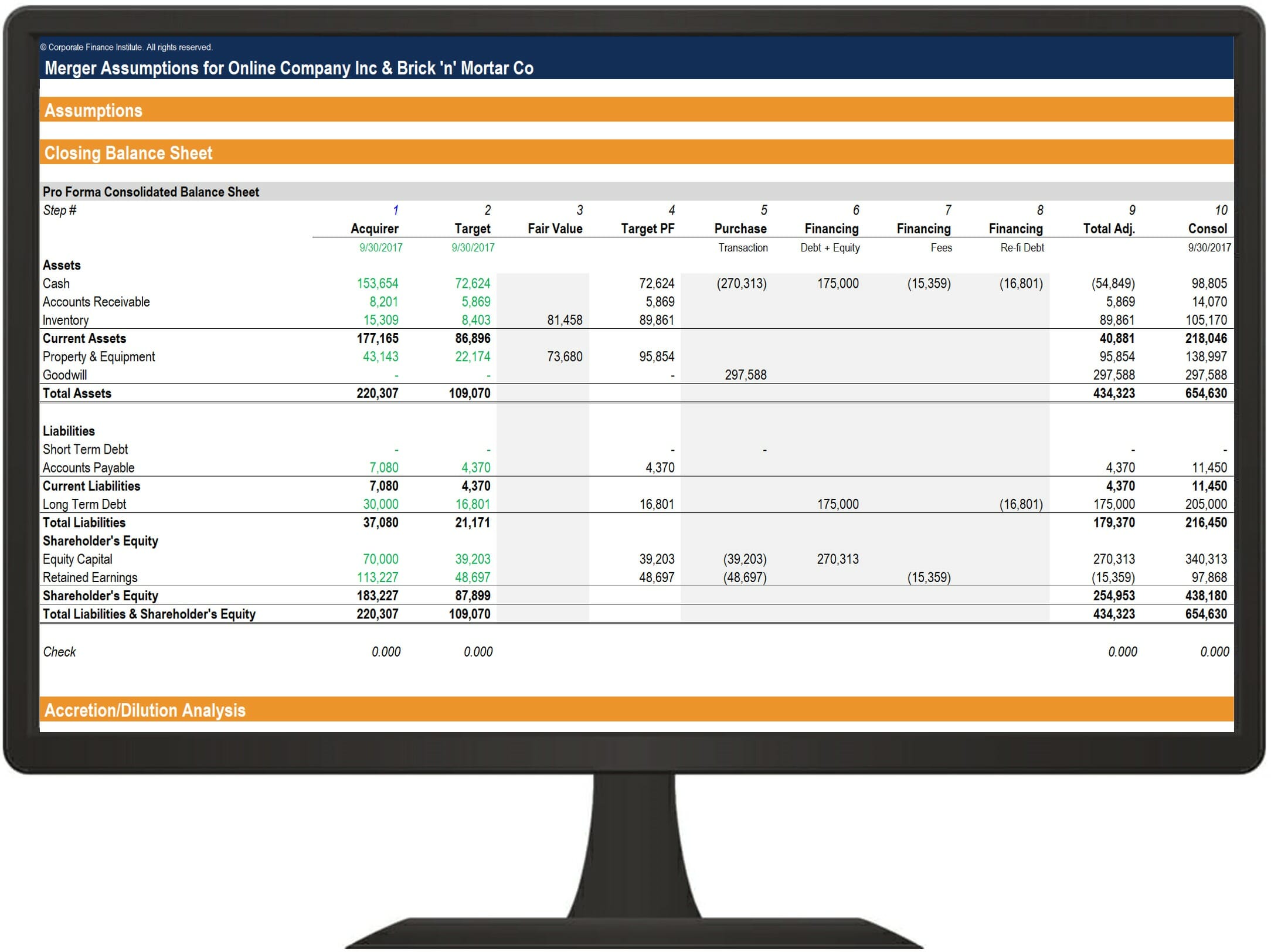

To customise it for your company, just add your historical numbers and adjust the inputs in the yellow tab called “Assumptions.” Once you are happy with them, you can make the consolidated reports into a PDF to present to investors. If you are interested in how these assumptions will affect your profit or cash balance, check out the detailed reports in the blue tabs.

Financial models can be crucial in bringing much needed visibility to business owners and investors. We offer a free consultation to discuss your needs and future plans.